Dimensional Equity Solutions

A convenient, long-term solution for investors who expect to retire in or around a particular year

GLOSSARY

Diversification: Holding many securities or types of investments in a portfolio, often for the purpose of mitigating risk associated with owning a single security or type of investment.

Relative price: A company’s price, or the market value of its equity, in relation to another measure of economic value, such as book value.

Profitability: A company’s operating income before depreciation and amortization minus interest expense scaled by book equity.

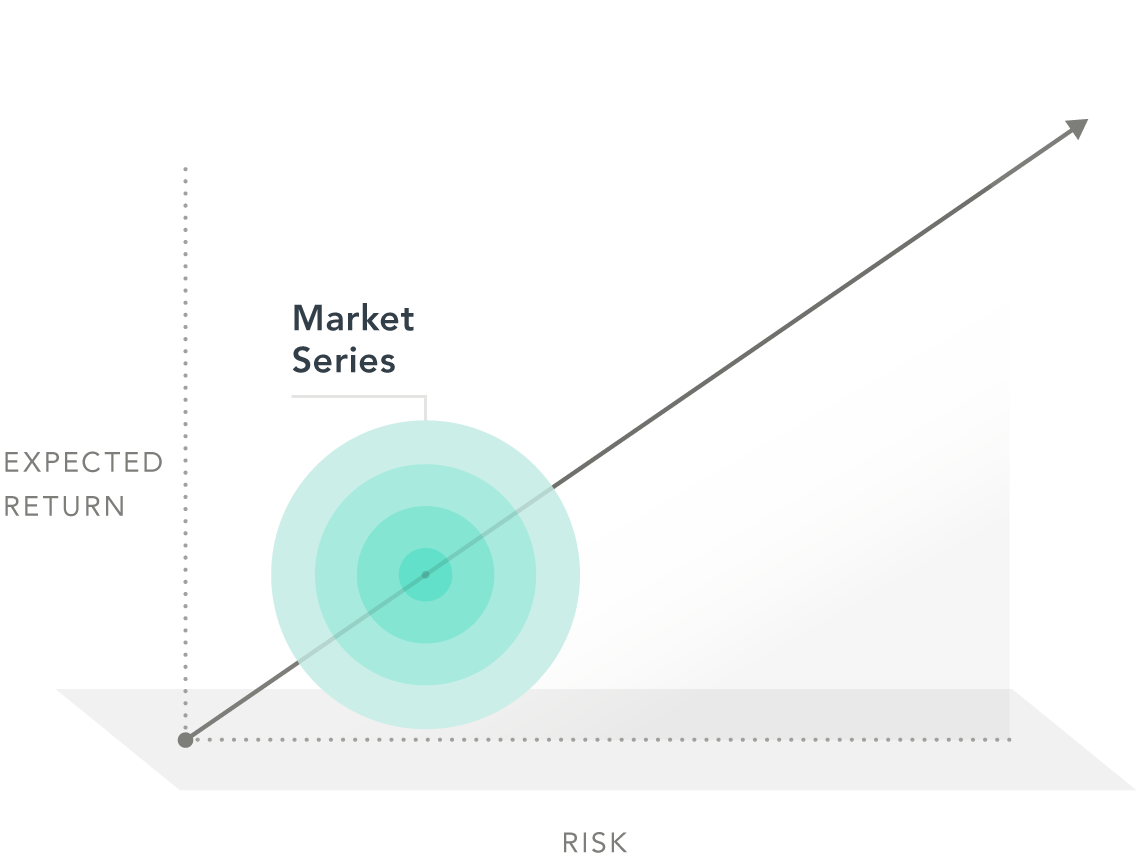

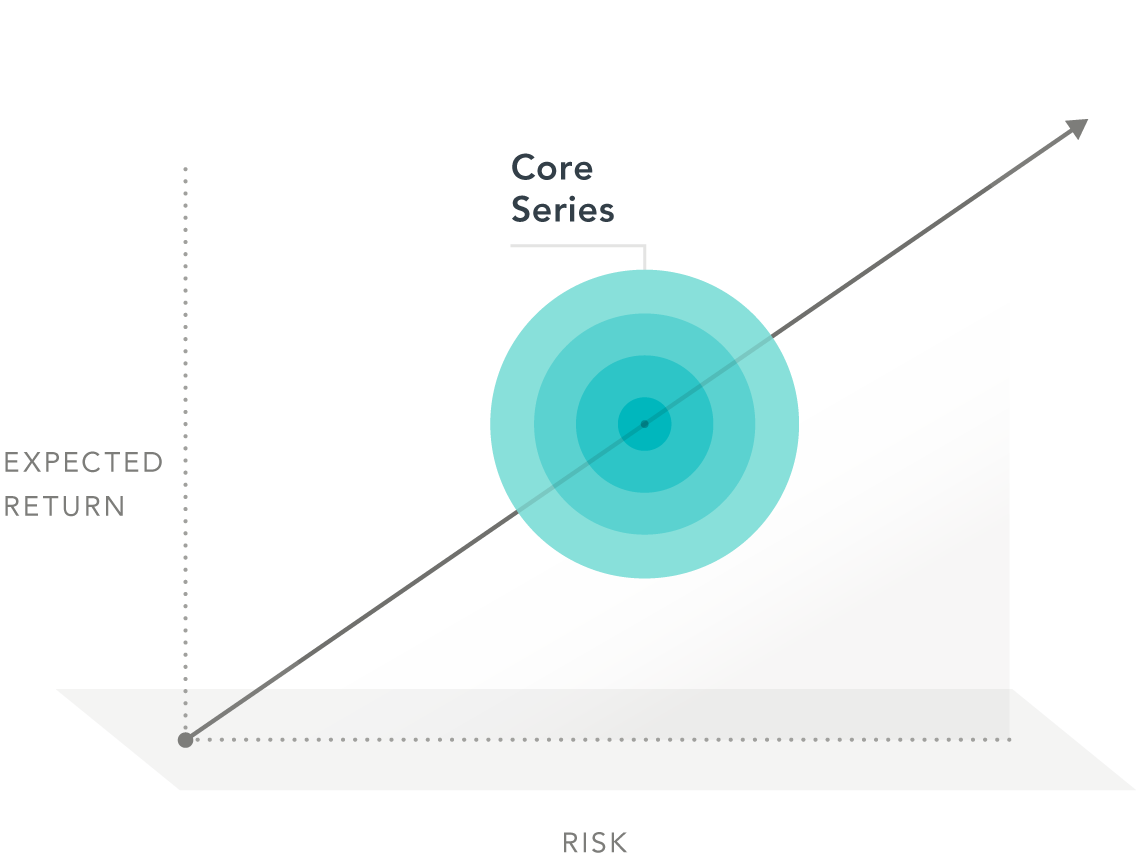

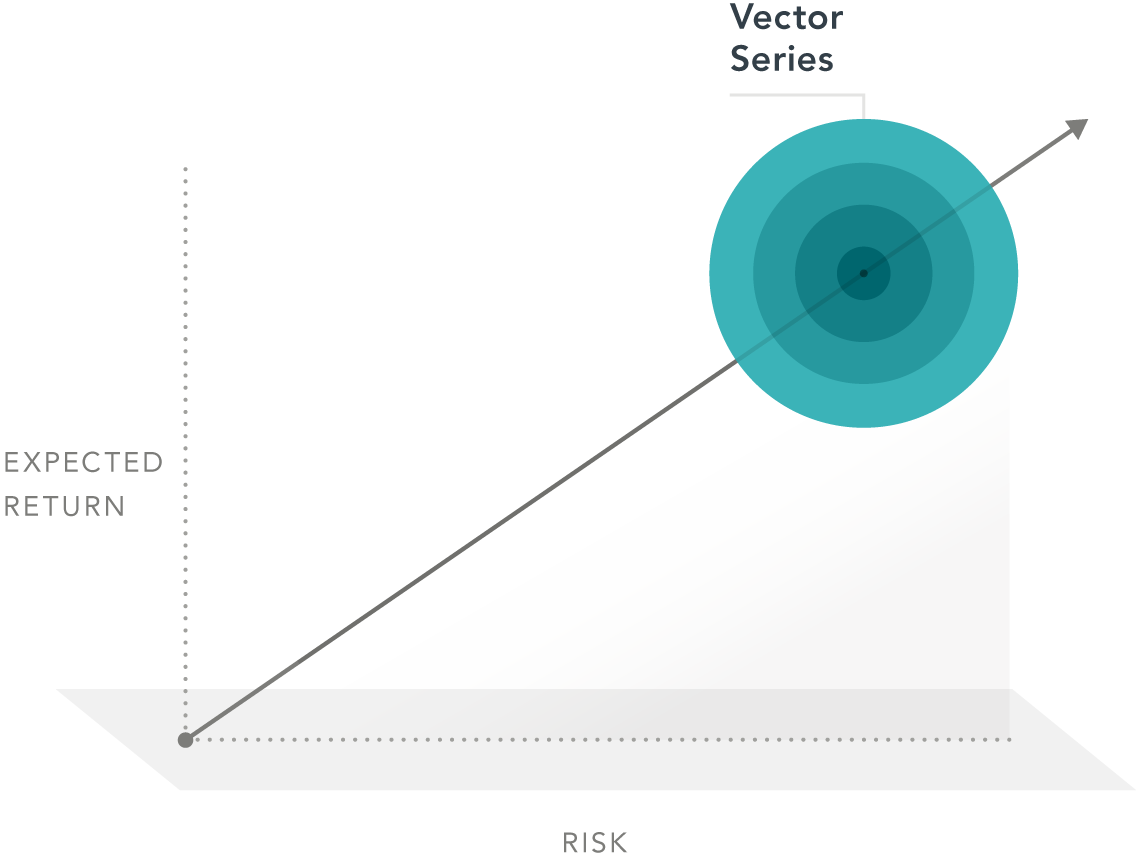

Expected return: An estimate of average anticipated returns informed by historical data.

DISCLOSURES

The majority of Dimensional funds are priced within the lowest quartile of their Morningstar category peer groups. Data as of March 31, 2025.

Risks include loss of principal and fluctuating value. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Small and micro cap securities are subject to greater volatility than those in other asset categories. Value investing is subject to risk which may cause underperformance compared to other equity investment strategies. International and emerging markets investing involves special risks such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Sector-specific investments focus on a specific segment of the market which can increase investment risks. These risks are described in the Principal Risks section of the prospectus.

There is no guarantee strategies will be successful. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at dimensional.com. Dimensional funds are distributed by DFA Securities LLC.

Nothing on this website shall constitute or serve as an offer to sell products or services in any country or jurisdiction by any Dimensional global firm. For informational purposes only. All information is given in good faith and without warranty and should not be considered investment advice or an offer of any security for sale.