Dimensional Celebrates ETF Milestones

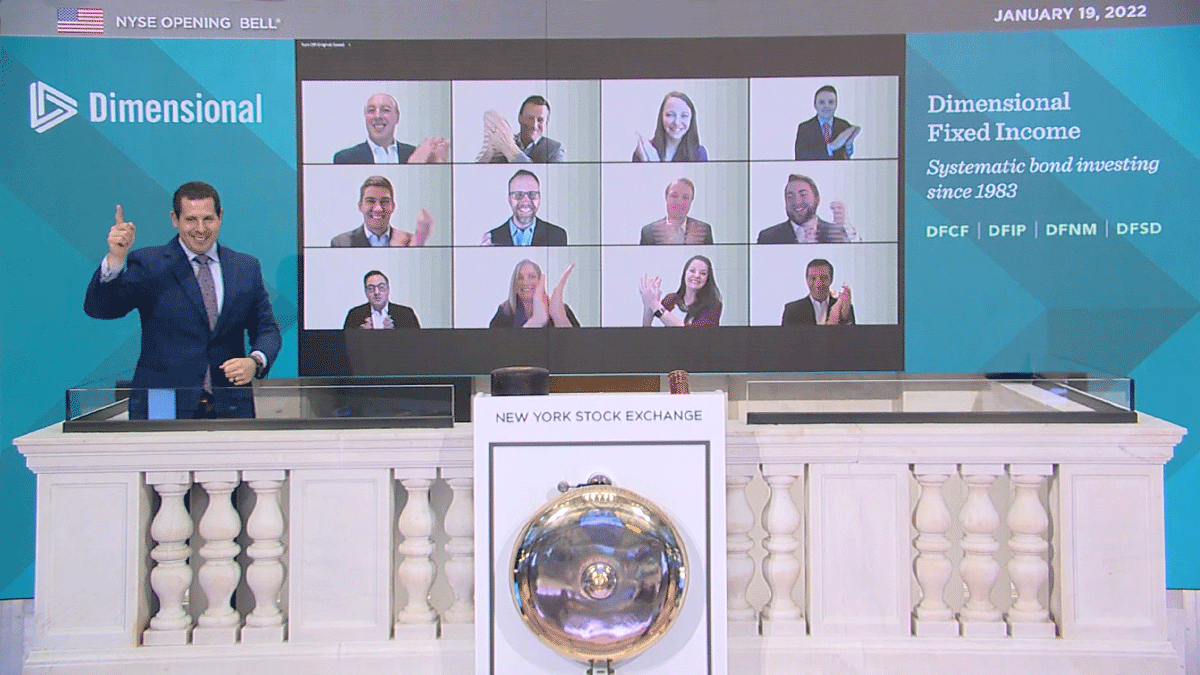

Dimensional Fund Advisors celebrated a major milestone in its growing offering of exchange-traded funds (ETFs) by ringing the Opening Bell at the New York Stock Exchange (NYSE) on January 19. The virtual event marked the successful launch of Dimensional’s first four bond ETFs. The fixed income strategies, which started trading in November 2021, recently surpassed $1 billion in assets under management, which highlights the strong demand for systematic fixed income in active transparent ETFs.

Dimensional first entered the ETF space in November 2020, with the launch of its first two active transparent ETFs. Since then, Dimensional has introduced a total of nine equity strategies and four systematic fixed income strategies and completed the industry’s largest mutual fund to ETF conversion to date.

Media outlets are taking notice of the firm’s success in ETFs.

Published January 18, a Bloomberg article described Dimensional as having “seized the crown” of largest active ETF manager just 14 months after debuting in the space. It credited a combination of organic growth and the firm’s “record-setting mutual fund conversions” for fueling the growth that has resulted in $46 billion in assets already under management. Commentary featured in ThinkAdvisor on January 20 also referenced the firm’s conversion of six mutual funds to ETFs, calling it a “smart strategy” that has “served investors well.”

Dimensional has announced plans to launch 10 more ETFs later this year. The firm’s growing ETF offering will ultimately cover a wide range of asset classes and sectors, providing financial professionals with the components to build complete asset allocation models using Dimensional ETFs.

For more about Dimensional ETFs, click here.|

About Dimensional Dimensional is a global investment manager with more than 40 years of experience going beyond indexing by providing diversified, low-cost solutions that also target higher expected returns.

|

Disclosures

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at dimensional.com. Dimensional funds are distributed by DFA Securities LLC.

This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.

Risks include loss of principal and fluctuating value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

ETFs trade like stocks, fluctuate in market value and may trade either at a premium or discount to their net asset value. ETF shares trade at market price and are not individually redeemable with the issuing fund, other than in large share amounts called creation units. ETFs are subject to risk similar to those of stocks, including those regarding short-selling and margin account maintenance. Brokerage commissions and expenses will reduce returns.