Trading ETFs

Trading exchange-traded funds (ETFs), like many investment decisions, involves making tradeoffs to pursue an outcome that best aligns with one’s goals. An ETF trade requires selecting an order type and its parameters, as well as determining when to place a trade during the trading day. Understanding the key decision points to place an order can help inform better trading decisions.

-

Common order types, market and limit orders, allow investors to balance tradeoffs between price, time, and quantity when placing ETF trades.

-

Investors should be mindful of potentially higher costs if trading near the market open, in the closing auction, or during times of high market volatility.

-

ETF liquidity is not limited to shares trading across exchanges. New shares can be created or existing shares redeemed to balance supply and demand.

-

Block trading desks at brokerage platforms may be a useful resource for investors that seek additional support for placing ETF orders.

Order Types: Balance between price, time, and quantity

Two common order types for placing ETF trades are market orders and limit orders. Each offers greater control over different aspects of an ETF trade, allowing investors to balance tradeoffs between achieving a desired price, the speed at which the order is executed, and certainty on the quantity of shares traded.

Market orders allow investors to specify a quantity of shares to trade at the best price available at the time of the trade. This allows the trade to be fulfilled as soon as possible but without control over the execution price.

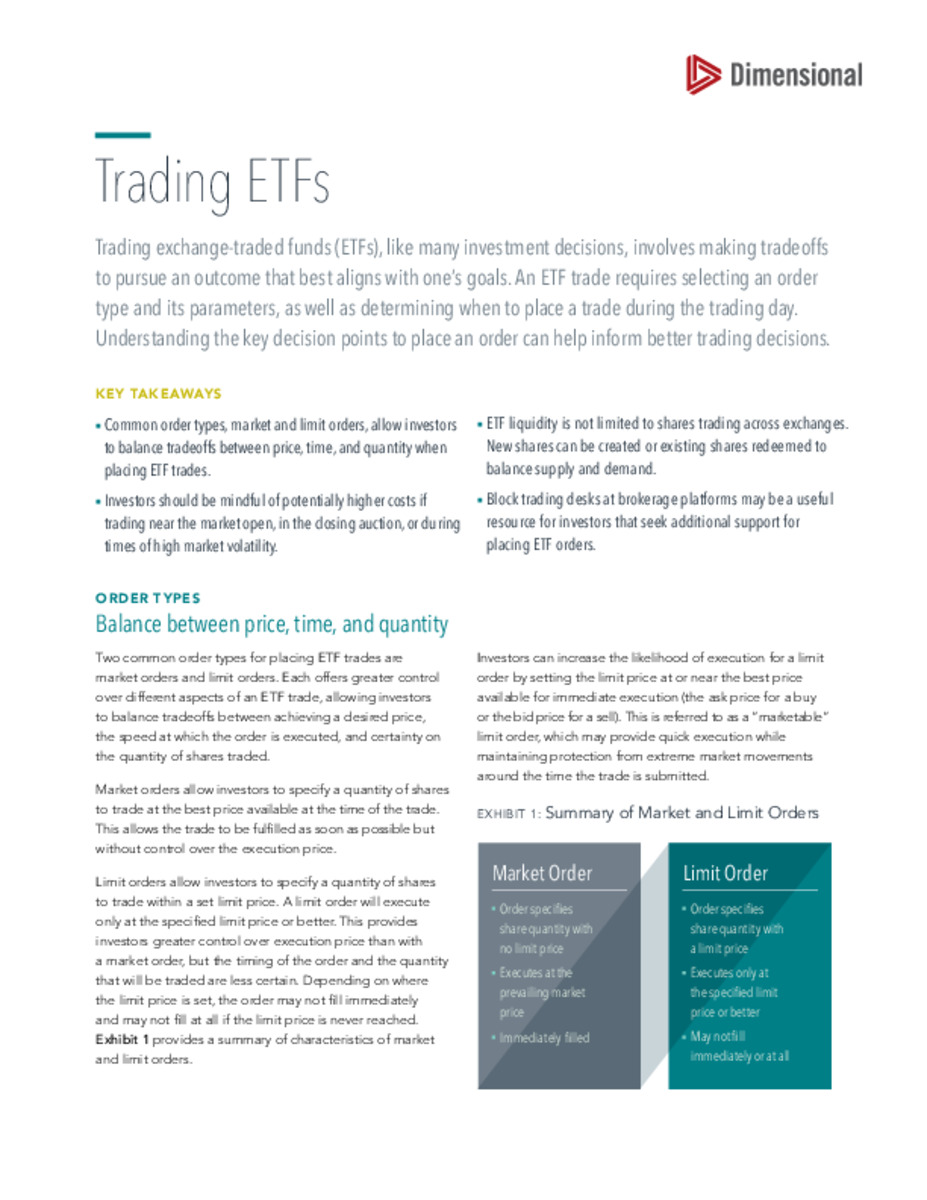

Limit orders allow investors to specify a quantity of shares to trade within a set limit price. A limit order will execute only at the specified limit price or better. This provides investors greater control over execution price than with a market order, but the timing of the order and the quantity that will be traded are less certain. Depending on where the limit price is set, the order may not fill immediately and may not fill at all if the limit price is never reached. Exhibit 1 provides a summary of characteristics of market and limit orders.

Summary of Market and Limit Orders

Investors can increase the likelihood of execution for a limit order by setting the limit price at or near the best price available for immediate execution (the ask price for a buy or the bid price for a sell). This is referred to as a “marketable” limit order, which may provide quick execution while maintaining protection from extreme market movements around the time the trade is submitted.

Exhibit 2 presents an example to illustrate the tradeoffs in setting limit prices. In this example, the ETF can currently be bought at the ask price of $10.05, and there are two buy limit orders with prices set at $9.95 and $10.05.

Limit Order Pricing Example

The first example limit order is set with a limit price $0.10 below the current ask price of $10.05. The order prioritizes achieving a better execution price than currently available in the market and will not execute until the market price drops to the limit price or until a seller places an order with willingness to accept a trade at that lower price to fulfill their full order. The second example limit order is set with a limit price at the current ask price of $10.05. This marketable limit order is likely to fill quickly given it matches the price currently available in the market. This order prioritizes speed of execution above achieving an execution price better than the current market price. Investors placing greater importance on speed of execution may prefer the marketable limit order, whereas investors placing greater importance on price may prefer a limit order further away from the market price. For both example orders, the limit price prevents buying at a higher price if the ETF price was to rise quickly as the order is being placed.

Order Timing: Consider times of potentially higher costs

ETF investors should consider that transaction costs may vary through time and can be larger at certain times during the trading day. Historically, we have observed that ETF spreads tend to be wider near the market open. This may result from greater pricing risk for authorized participants (APs) and dealers making markets in an ETF when some of an ETF’s underlying holdings have not yet begun trading on the day.

Investors should also be mindful of trading in the closing auction, when buy and sell trades are aggregated and executed at the final closing price. We observe lower trading volumes on average in the closing auction, and dealers may have more flexibility to provide liquidity for trades occurring throughout the day.

ETFs may additionally see wider-than-average spreads during periods of high market volatility. As uncertainty increases in the market, costs to APs and market makers that impact ETF spreads, such as the costs to assemble the creation or redemption basket and hedging costs, can increase. Those costs may be passed on to investors in the form of higher ETF spreads. For investors that need to place trades during times of high market volatility, a limit order is one way that they can help protect themselves from fluctuations in ETF prices or avoid crossing large spreads.

ETF Liquidity: There’s more beyond the screen

When assessing the liquidity of an ETF, investors should be aware that there’s often more than meets the eye, or that can be seen in the online quote book of a brokerage platform (“on-screen liquidity”). ETF liquidity is not limited to the shares trading across exchanges, which takes place in the secondary market. ETF shares can be created or redeemed each day in what is known as the primary market in order to meet investor demand. This process involves an AP exchanging securities and (or) cash with the ETF sponsor for ETF shares.

The primary and secondary markets for ETFs provide multiple layers of ETF liquidity.1 Because new ETF shares can be created or redeemed as needed to balance supply and demand, measures such as an ETF’s average daily traded volume (ADV) or assets under management (AUM) may not be representative of an ETF’s total liquidity.

Trade Support: Understand the available resources

For investors that need additional support with executing ETF trades or access to liquidity beyond what can be seen on screen, block trading desks at brokerage and custodial platforms could be a valuable resource. These trading desks can help to facilitate efficient execution of larger orders. Platforms often have processes to automatically identify and route large orders placed within their system to their trading desk for handling.

While what qualifies as a large order and the services provided may vary across different platforms, support offered generally includes coordination with market makers to obtain trade quotes or working with APs on creation and redemption of ETF shares. Investors should understand the resources available to them through their platform and consider that these tools may help to improve ETF trading outcomes.

Download this Guide

Download a copy of this guide to print, share or use offline.

View PDFFootnotes

-

1Multiple layers of ETF liquidity refers to liquidity available in the secondary market and that can be generated in the primary market through ETF share creation and redemption activity between APs and an ETF sponsor. This is unlike an individual stock, which generally has a fixed supply of shares in the secondary market. An AP may request to create or redeem ETF shares in order to provide liquidity to large ETF orders or to help balance supply and demand for ETF shares on the secondary market.

Definitions

Creation/Redemption Basket: The securities and (or) cash requested by an ETF sponsor to be exchanged for ETF shares in the ETF share creation and redemption process.

Bid/Ask Spread: The difference between the highest price (bid) that a buyer is willing to pay for a security and the lowest price (ask) that a seller is willing to accept.

Disclosures

Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at dimensional.com. Dimensional funds are distributed by DFA Securities LLC.

ETFs trade like stocks, fluctuate in market value, and may trade either at a premium or discount to their net asset value. ETF shares trade at market price and are not individually redeemable with the issuing fund, other than in large share amounts called creation units. ETFs are subject to risks similar to those of stocks, including those regarding short-selling and margin account maintenance. Ordinary broker commissions may apply.

This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.