1971: The Beginning of a New Way to Invest, Based on Science

I’d rather be an investor in 2024 than in 1971. Back then, investment options were limited, opaque, and expensive. Portfolios were based on predictions and often highly concentrated.

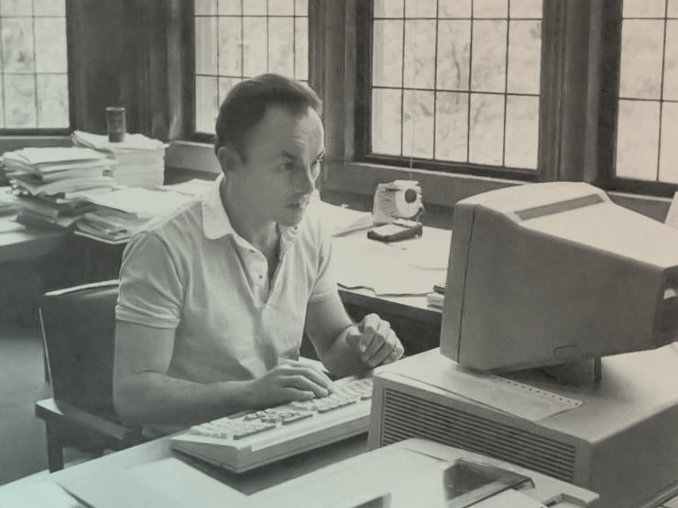

Starting in the mid-1960s when computers became available, leading academics began developing and testing theories with stock market data. Within a short period of time, seminal research came out that paved the way for investing to shift from being a speculative sport to becoming a science.

So, what did these academics uncover? For one, professional money managers performed no better than you’d expect by chance. After fees, they performed worse than chance and their results looked random. Gene Fama at the University of Chicago developed the efficient market hypothesis, which offered a sensible theory as to why. His main insight was that markets do a good job incorporating all available information and driving it into prices. That’s great news for investors because it means you can win without having to identify pricing “mistakes” or predict the future. In many ways, it heralded the democratisation of investing.

I was lucky to be at the University of Chicago as many of these new ideas were being developed. It’s hard to describe how exciting it was. Groundbreaking ideas led to more research and more questions. It inspired me to put these ideas into practice.

Fast-forward to 1971. One of the first index funds, which I worked on with Mac McQuown when he led the management sciences division at Wells Fargo Bank, was an initial step in applying these insights. Mac had what is now the “who’s who” list of academics consulting with the team. Several went on to earn Nobel Prizes. We asked ourselves, “If it’s difficult for investors to consistently pick winners, is there a way to beat the market without outguessing it?”

The group contemplated different weighting schemes and adding leverage as potential ways to perform better. That led to our launching an equally weighted New York Stock Exchange index fund. Two attributes emerged as important when forming an index portfolio: maximising diversification and minimising costly trading. Shortly after our launch, the trust department at Wells Fargo came up with the idea of simply tracking the S&P 500 Index using market-cap weighting. That caught people’s imaginations because it’s easy to explain and cheap to do.

Indexing was revolutionary at the time, because it meant that investors could finally capture market returns without trying to time the market or pick stocks. It also created a new standard of manager accountability that was easy to monitor. Unless the index fund matched the returns of the index minus its fees, managers weren’t doing their jobs. But what started as a way to hold managers accountable became an obsession with zero tracking error. This fixation on matching—rather than beating—benchmarks is unnecessarily rigid. It shortchanges the investor and leaves money on the table. That’s why, soon after creating the first index funds, my colleagues and I were driven to create something even better.

When we founded Dimensional in 1981, we wanted to give investors the opportunity to do better than indexing, while still maintaining the virtues of diversification and low costs. We call this better way Dimensional Investing. Our first advantage is structural, designing portfolios informed by financial science. Weighting stocks by market capitalisation, as many indexes do, is not the only way to form a diversified portfolio with exposure to a market segment. Subsequent research has found that not all stocks have the same expected returns, so we systematically emphasise dimensions of the market that historically have outperformed.

Second, implementation matters. While many indexes rebalance as infrequently as once or twice a year, staying flexible allows you to buy and sell securities every day based on up-to-date information on what can improve returns. Engineering portfolios and implementing well is what Dimensional has been doing and improving upon for 43 years. Because we’re not beholden to a rigid goal of matching an index, we trade what we want to, and when.

That flexibility has been a key source of value, because it allows us to seek better prices than index funds may get. Myron Scholes and Robert Merton became Nobel laureates for their options pricing model, which highlighted the merits of flexibility. The insight applies well beyond options—more flexibility in implementation could give investors a better deal while still allowing them to benefit from the positives of indexing. Flexibility is key to distinguishing what we do at Dimensional from what indexers have been doing for 50 years.

It is remarkable to look back at 1971 and see how much the world has changed. When it comes to investing, people are having a much better experience today—fees are lower, transparency is higher, and our understanding of markets has advanced. We founded Dimensional with the belief that we could do better for investors, and looking back over the last four decades, we have.

Disclosures

FOR PROFESSIONAL USE ONLY. NOT FOR USE WITH RETAIL INVESTORS OR THE PUBLIC.

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

UNITED STATES

This information is provided for registered investment advisors and institutional investors and is not intended for public use. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

CANADA

This material is issued by Dimensional Fund Advisors Canada ULC for advisors, dealers, and institutional investors and is not intended for public use. The other Dimensional entities referenced herein are not registered resident investment fund managers or portfolio managers in Canada.

This material is not intended for Quebec residents.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise noted, any indicated total rates of return reflect the historical annual compounded total returns, including changes in share or unit value and reinvestment of all dividends or other distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

AUSTRALIA

In Australia, this material is provided by DFA Australia Limited (AFSL 238093, ABN 46 065 937 671). It is provided for financial advisors and wholesale investors for information only and is not intended for public use. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs.

NEW ZEALAND

This material has been prepared and provided in New Zealand by DFA Australia Limited, (incorporated in Australia, AFS License No.238093, ABN 46 065 937 671). This material is provided for financial advisers only and is not intended for public use. All material that DFA Australia Limited provides has been prepared for wholesale clients and is not to be disseminated to retail clients or reproduced in any form. This material is general information only, does not give any recommendation or opinion to acquire any financial advice product, and does not constitute financial advice under the Financial Markets Conduct Act 2013 (NZ) to you or any other person.

WHERE ISSUED BY DIMENSIONAL IRELAND LIMITED

Issued by Dimensional Ireland Limited (Dimensional Ireland), with registered office 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland. Dimensional Ireland is regulated by the Central Bank of Ireland (Registration No. C185067).

Directed only at professional clients within the meaning of Markets in Financial Instruments Directive (MiFID) (2014/65/EU).

WHERE ISSUED BY DIMENSIONAL FUND ADVISORS LTD.

Issued by Dimensional Fund Advisors Ltd. (Dimensional UK), 20 Triton Street, Regent’s Place, London, NW1 3BF. Dimensional UK is authorised and regulated by the Financial Conduct Authority (FCA) - Firm Reference No. 150100.

Directed only at professional clients as defined by the rules of the FCA.

Dimensional UK and Dimensional Ireland issue information and materials in English and may also issue information and materials in certain other languages. The recipient’s continued acceptance of information and materials from Dimensional UK and Dimensional Ireland will constitute the recipient’s consent to be provided with such information and materials, where relevant, in more than one language.

NOTICE TO INVESTORS IN SWITZERLAND: This is advertising material.

JAPAN

FOR FINANCIAL INSTITUTIONS AND FINANCIAL ADVISORS. NOT FOR USE WITH RETAIL INVESTORS OR THE PUBLIC.

This material is deemed to be issued by Dimensional Japan Ltd., which is regulated by the Financial Services Agency of Japan and is registered as a Financial Instruments Firm conducting Investment Management Business and Investment Advisory and Agency Business.

Dimensional Japan Ltd.

Director of Kanto Local Finance Bureau (FIBO) No. 2683

Membership: Japan Investment Advisers Association

FOR LICENSED OR EXEMPT FINANCIAL ADVISORS AND INSTITUTIONAL INVESTORS IN SINGAPORE

This material is deemed to be issued by Dimensional Fund Advisors Pte. Ltd. (UEN:201210847M), which is regulated by the Monetary Authority of Singapore and holds a capital markets services license for fund management.

This material is not an advertisement, has not been reviewed by the Monetary Authority of Singapore or the Central Provident Fund (CPF) Board, and should not be shown to prospective investors or the public.

For use by institutional investors and licensed or exempt financial advisors only in Singapore for internal training and educational purposes and not for the purpose of inducing, or attempting to induce, such institutional investors or financial advisors to make an investment. Not for use with the public.

FOR LICENSED FINANCIAL ADVISORS AND INSTITUTIONAL INVESTORS IN HONG KONG

This material is deemed to be issued by Dimensional Hong Kong Limited (CE No. BJE760), which is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

For use by licensed financial advisors and institutional investors who are “professional investors” (as defined in the Securities and Futures Ordinance [Chapter 571 of the Laws of Hong Kong] and its subsidiary legislation) only in Hong Kong. This material is provided solely for internal training and educational purposes and is not for the purpose of inducing, or attempting to induce, such financial advisors and institutional investors to make an investment nor for the purpose of providing investment advice. Not for use with the public. This material is not intended to constitute and does not constitute marketing of the services of Dimensional Hong Kong or its affiliates to the public of Hong Kong.

Financial advisors in Hong Kong shall not actively market the services of Dimensional Hong Kong Limited or its affiliates to the Hong Kong public.